Alpinum Investment Management | Market Intelligence | Alternative Investments | Private Markets

Private Markets

Key takeaways

- Private markets’ refer to illiquid assets, which are non-tradable at public markets such as private equity, real estate, infrastructure or private debt.

- Private markets have grown considerably in size over the last decade and play a key role in institutional portfolio construction nowadays.

- The search for attractive returns, high-income streams and diversification benefits brought private assets to their current prominence.

- Strategies such as distressed debt, buyouts and private credit are not accessible in a liquid format.

- Successful implementation requires strong manager selection skills, efficient cash management and broad portfolio diversification on “all levels”.

What are private markets

Private markets’ have become an umbrella term to refer to assets that are not liquid and are not traded on organised public market exchanges. The most common segments include private equity, real estate, infrastructure and private debt.

Private markets have grown sizably over the last decade and are becoming an increasingly important role in nowadays portfolio allocations. At the same time, they became a vital source of equity and debt financings for companies.

Collecting an illiquidity premium

Illiquid investments’ common inefficiencies have enabled investors to collect a return premium compared to an equivalent liquid investment. This difference is typically referred to as the “illiquidity premium”, which is an excess return that investors earn for not immediately redeeming or selling their investment. Therefore, the commonly used methodology to assess the efficiency of an investment with its risk-/return ratio is a limited framework and should consequently be complemented by a third dimension – “liquidity”.

Rationale to invest in illiquid markets

Investing in illiquid assets has the benefits of patient investing as it inherently fosters a long-term view and an associated focus on well-designed portfolio construction. Our experience documents this long-term value creation well, as our portfolios have delivered consistent and attractive performance.

While access to private markets used to be largely limited to institutional investors with large portfolios and investment teams, it is now also accessible for wealthy private individuals.

Alpinum IM is a specialist in private debt and direct lending investments. We offer access to a broad and diverse investment universe, ranging from high-profile managers for core allocations to brand names for a satellite approach, co-investments and customized mandates. This allows our clients to invest in the private debt markets in a systematic and consistent manner that is fully tailored to their needs and investment objectives.

1. Return

Search for high returns and capital growth.

2. Income Stream

Need for steady income and cash flow streams.

3. Differentiated sources of return

Private markets provide access to strategies not available through public markets (e.g. distressed, buyouts, private credit, etc.) and help to diversify “traditional” portfolios.

4. Opportunity

The number of publicly-traded companies has been shrinking since the early 2000s, while the number of private equity-owned companies has been steadily increasing. Consequently, investors who focus only on public markets are missing out on a large opportunity set.

Portfolio Construction requires Expertise and Experience

Direct Lending

Secured Lending

Secured Lending describes loans, which are secured by a collateral. We classify this type of lending as a sub-category of the private debt investment universe. The strategy unifies the benefits and attractiveness of a niche and specialized market. The strategy gathers an illiquidity and complexity premium, while facing reduced risk of losing capital as the loan is backed by a collateral. We specifically like hard assets as collateral and identified the bridge loan market for real estate financing as particularly attractive.

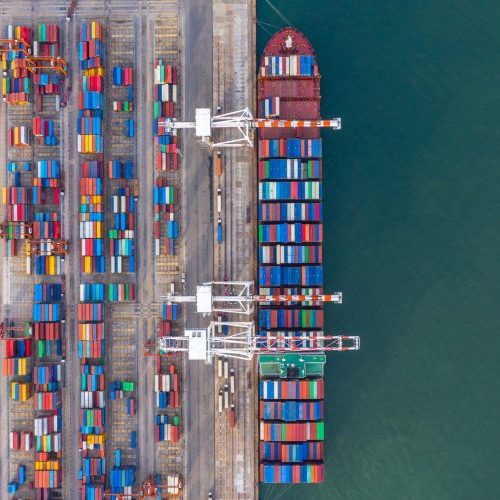

Trade Finance

“Trade Finance” finances the processing and shipment of goods and commodities from the supplier’s location to the location of the buyer. These are typically cross-border transactions from one country or continent to another. The financing is performed via privately negotiated loans, a “lending format” that has historically mainly been performed by banks. However, over the last years, trade financing has substantially expanded into the private alternative lending sector. The attractiveness of such financing is that the loans are short term in nature and secured by a liquid collateral.