Alpinum Investment Management | Market Intelligence | Credit | Credit Universe

Credit Universe

Key takeaways

- In search of higher returns investors started to tap the high yield bond (“HY”) market as the new “hunting ground” to compensate for the former low (or even negative) yielding interest rate environment.

- The credit market is not limited to HY bond investments but rather offers a wide and deep investment universe.

- Investors can capitalize on a wide variety of income streams. Such income sources are, for example, specific local or niche markets, complexity premiums in the structured credit market or illiquidity premiums for less traded instruments or private debt loans.

- Sourcing and analysis of credit investments are complex and time-consuming. Credit risk is not limited to default and duration risk, and therefore, the analysis requires both deep expertise and a long-lasting experience.

Tapping the depth and breadth of the credit universe

The credit universe is deep and wide. Besides government and investment grade bond investments, many investors have started to tap the high yield bond (“HY”) market. As a consequence, the global HY market has substantially grown to more than USD 2 trillion in size over the last years.

However, there exist many other credit markets, which differentiate in terms of risk (i.e. expected corporate default risk), liquidity, complexity and return expectations. For example, we prefer investments in senior secured loans vs. traditional high yield bonds thanks to their superior default statistics. In addition, loans don’t face a relevant duration risk given their embedded floating rate mechanism they bear. Please see below the total return chart of the S&P US Loan Index in a historical perspective for the asset class, which resulted so far in an return of ~5% p.a. with a constant yield income.

US Leveraged Loan TR index – Attractive long term yield generation

Source: : Moody’s (average between 1981-2017)

Portfolio framework for a constant efficient yield generation

Source: Alpinum Investment Management

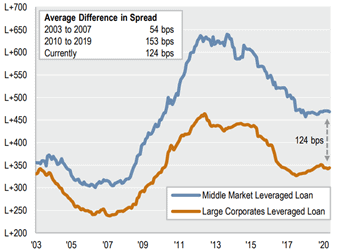

Spread level between large & middle market loans

Private debt markets offer an attractive “illiquidity” premium, which can be gathered by investors who can and/or willing to invest in less liquid investment vehicles. The chart below illustrates the additional spread level generated between liquid large-cap and middle-market loans.

Please find more information about private loans in the section direct lending on our web-site.

Source: Alpinum Investment Management